Tax season is here. And while all our great real estate friends and partners are already in the thick of what is sure to be another unpredictable and promising year of closings, it’s time to turn our attention to your 2021 1099-S reporting.

This is not the most exciting topic in the world, but it’s one that is very important to you – and to us. Hopefully, you’re following the advice of our very own 1099 support team and running your reports monthly to keep track of your 1099s as you go, but if not, that’s OK. There are many ways SoftPro can help simplify your filing process, and we’re here to share all of them.

After all, your SoftPro team is here to help save you as much time and effort as possible so that you can get back to the work that you do best: providing fast, efficient, and accurate closing services to your clients.

Keep reading for important dates, information, and tips we’ve compiled for you to reference as you prepare your 2021 1099-S filings. And be sure to download our free guides with more information about our Pro1099 module and how it can help you simplify your filing process.

2021 Tax Year Updates

We’ve talked about this before, but in case you didn’t know, the IRS has instituted a change affecting 2021 tax year 1099-S submission files. This requires you to apply a new script update before completing and submitting your 1099-S filings.

For more information on how to do so, along with other important filing information, how-to videos and more, check out our resource pages:

Important Dates for 2022

| Recipient (Seller) 1099-S copy must be postmarked by: | February 15th |

| Paper filing of 1099 deadline postmarked by (limited up to 249 records only): | February 28th |

| Last day to submit a test file: | March 16th |

| Electronic IRS filing of 1099 deadline for upload to IRS FIRE site by: | March 31st |

| Extension request to extend 1099 filing deadline submitted via IRS FIRE site by: | March 31st |

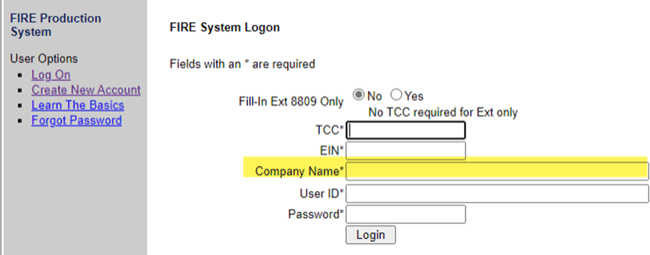

REMINDER: Login to FIRE Requires a Company Name

When filing electronically, your login requires you to include your company name. Should you have any issues, there are a couple of steps you can take before contacting the IRS. Try removing the punctuation and locating your letter from the IRS with the TCC code and Company Name provided. Should you need to contact the IRS, call between 8:30 am and 4:30 pm EST and be prepared to be on hold.

IRS Contact Info: (866) 455-7438

What to Do If Your File is Marked BAD by the IRS

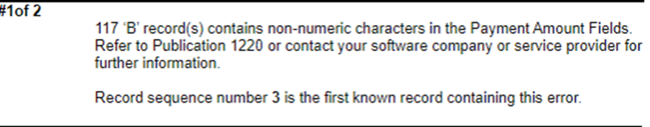

Don’t panic. It happens. If you have not updated your 1099 program after January 21st, you’ll need to install the latest 1099 update, recreate your submission file, and upload it to IRS FIRE as a replacement. Make sure to review the details. Check out the example below of an IRSTAX submitted with the old Format.

Need help? Simplify Your 1099-S Filings with Pro1099

SoftPro’s Pro1099 module is exactly what you need to make tracking your 1099-S forms as painless as possible. Like all of our products and services, Pro1099 comes with access to our award-winning support team. Pro1099 can help you with:

- 1099-S record management (search, report, view, add, delete)

- Warnings to alert you of any 1099-S errors (available to SoftPro Select users)

- Exception reporting for missing or erroneous information for sellers that are reportable

- Electronic submission to the IRS FIRE site

- Data import/export to your 1099-S management module

Learn more about Pro1099 with the following resources:

- Pro1099 guide for SoftPro Standard & Enterprise users

- Pro1099 guide for SoftPro Select users

- Watch our webinar, Saved You a Seat Episode 33: Tips for Your 2021 1099-S Filings

Are you interested in getting started with the Pro1099 module? Contact us today for more information or to schedule a free demo: